Get the free dr1366 form

Show details

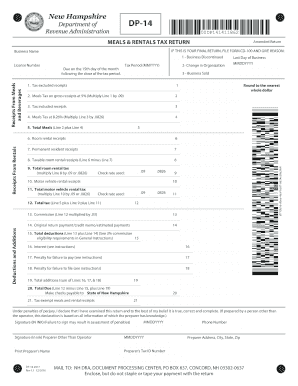

130075 19999 DR 0075 07/19/13 colorado department of revenue Denver CO 80261-0005 Certification of Qualified Enterprise Zone Contribution Note- In order to claim an Enterprise Zone credit you must electronically file your income tax return and the EZ Carryforward Schedule DR 1366.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dr1366 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr1366 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dr1366 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form dr 1366. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out dr1366 form

How to fill out dr1366:

01

Start by entering your full name in the designated field.

02

Provide your contact information, including your address, phone number, and email address.

03

Indicate your social security number or taxpayer identification number.

04

Fill in the details of your income, including wages, salaries, and any other sources of income.

05

Deduct any adjustments to your income, such as student loan interest or contributions to a retirement account.

06

Calculate your taxable income by subtracting the deductions and exemptions from your total income.

07

Determine your tax liability using the tax rate table provided or the appropriate tax software.

08

Report any tax credits or payments you have already made towards your tax liability.

09

If you owe additional taxes, include the payment with your completed form.

10

Sign and date the form before submitting it to the appropriate tax authority.

Who needs dr1366:

01

Individuals who need to file their annual income taxes

02

Taxpayers who want to claim deductions, credits, and exemptions

03

Individuals who have received income from various sources that need to be reported

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dr1366?

There is limited information available about "dr1366" as it is not a well-known term or concept. Without further context or clarification, it is difficult to provide a specific answer. It may refer to a specific technical or scientific topic, code, abbreviation, or even a username or identifier related to a certain individual or organization. Clarification would be helpful in providing a more accurate response.

Who is required to file dr1366?

In regard to the question, "Who is required to file dr1366?", more information is required to provide an accurate answer. The term "dr1366" does not reference any common or widely known form or document. It is possible that it might be specific to a certain jurisdiction, organization, or industry. Providing additional details regarding the context or purpose of "dr1366" would be helpful in providing a more precise response.

How to fill out dr1366?

To fill out Form DR1366, you need to follow these steps:

1. Download the form: Visit your state's department of revenue website or the official Colorado state tax website to download Form DR1366. Make sure you have the latest version.

2. Enter your personal information: Provide your name, Social Security Number, and address in the designated spaces at the top of the form.

3. Indicate your filing status: Check the appropriate box to indicate your filing status, such as single, married filing jointly, etc.

4. Compute your estimated tax liability: In Part I of the form, follow the instructions to determine your estimated tax liability for the year. This section helps calculate any taxes due or overpayment for the year.

5. Estimate tax payments and credits: In Part II, list any estimated tax payments you made throughout the year and any credits that may apply to you. This can include income tax withholdings, estimated payments, and any credits you are eligible for.

6. Calculate amount due or refund: Subtract your estimated tax payments and credits from your estimated tax liability (computed in Part I). This will give you the amount of taxes due or a potential refund.

7. Sign and date the form: Once you have completed the form, sign and date it at the bottom. If filing jointly, both spouses must sign the form.

8. Submit the form: Send your completed form to the Colorado Department of Revenue at the address provided on the form or the state tax website. Make sure to attach any additional documents requested, such as W-2 forms or other tax statements.

Note: It is recommended to consult with a tax professional or refer to the official instructions provided with the form to ensure accurate completion.

What information must be reported on dr1366?

Dr1366 is the form used to report information related to purchases of tangible personal property from out-of-state sellers for resale in Colorado. The following information must be reported on Dr1366:

1. Purchaser information: The name, address, and Colorado Account Number of the purchaser (the Colorado business purchasing the tangible personal property).

2. Seller information: The name, address, and Colorado Account Number of the seller (the out-of-state business selling the tangible personal property).

3. Transaction information: The date of the purchase, the description of the tangible personal property purchased, the total sales price of the transaction, and any applicable discounts or deductions.

4. Verification and certification: The form must be signed by an authorized person representing the purchaser, certifying that the information provided is true, complete, and accurate.

It is important to note that this information may vary by jurisdiction, so it is always advisable to consult the specific instructions provided with the Dr1366 form or the relevant tax authorities for the most accurate and up-to-date reporting requirements.

What is the penalty for the late filing of dr1366?

The penalty for late filing of form DR1366 (Colorado Sales and Use Tax Return) can vary depending on the specific circumstances and the regulations of each state. In Colorado, if a taxpayer fails to file their sales tax return by the due date, they may be subject to penalties and interest charges.

As per the Colorado Department of Revenue's regulations, the late filing penalty is based on the amount of tax owed and the number of months the return is delinquent. The penalty is calculated as follows:

- For returns filed within 30 days of the due date: A late filing penalty of 2% of the tax due will be assessed.

- For returns filed after 30 days of the due date, but within 90 days: A late filing penalty of 5% of the tax due will be assessed.

- For returns filed after 90 days of the due date: A late filing penalty of 10% of the tax due will be assessed.

In addition to the late filing penalty, interest will also accrue on any unpaid tax from the original due date until the tax is paid in full. The interest rate is determined annually by the Colorado Department of Revenue.

It's important to note that these penalties and interest charges can vary and it is advisable to consult the official guidelines and regulations provided by the Colorado Department of Revenue for specific and accurate information.

How do I modify my dr1366 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form dr 1366 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute co dr 1366 online?

pdfFiller has made it easy to fill out and sign colorado dr 1366. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit colorado dr 1366 instructions on an iOS device?

Create, edit, and share colorado form dr 1366 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your dr1366 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co Dr 1366 is not the form you're looking for?Search for another form here.

Keywords relevant to dr 1366 instructions form

Related to dr 1366

If you believe that this page should be taken down, please follow our DMCA take down process

here

.